hawaii capital gains tax rate 2021

The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. Help users access the login page while offering essential notes during the login process.

How To Calculate Capital Gains Tax H R Block

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Oahu tax bills will be mailed to property owners by July 20 2021. 35 Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains.

Capital gains tax rates on most assets held for a year or less correspond to. If zero or less enter zero. Increases the alternative capital gains tax for corporations from 4 to 5.

The rate slowly goes up in seven iterations until you reach the highest rate which is 1 for property transfers of 10000000 or more and 125 for non-residents. Applies for tax years beginning after 12312020. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

The tax rate for Oahus new Bed Breakfast Home category is 650 per 1000 assessed value. This is your long-term capital loss carryover from 2021 to 2022. The home exemption reduces your property tax rate to the low 350 per 1000 035 residential rate starting July 1 st 2022.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate. This is your long-term capital loss carryover from 2021 to 2022. The detailed information for Oregon Capital Gains Tax 2020 is provided.

1 increases the Hawaii income tax rate on capital gains from 725 to 9. That applies to both long- and. The rate that the transfer is taxed at depends on its value.

May 6 1991 The Walt Disney Company Joins The Dow Jones Industrial. Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis. Hawaiis capital gains tax rate is 725.

Hawaii has a graduated individual income tax with rates ranging from 140 percent to 1100 percent. This new BB Home property tax rate will apply to properties obtaining new permits under CO 19-18 and does not affect the property tax rate for existing NUC properties BBs TVUs. Oregon Capital Gains Tax 2021.

Composition of federal Individual Income in Hawaii Income Source Rate Wage Salaries Variable See tax bracket Pensions IRA distributions 0 Employer contributions exempt Self-employment income Variable see tax bracket Social security 0 exempt Capital Gains 725 Interest Dividends Variable see tax bracket 20. Hawaiis capital gains tax rate is 725. Increases the corporate income tax and.

If you are eligible as an owner occupant you may claim your Home Exemption by September 30 2021 but only if the property is your primary residence. Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

For Hawaii residents transferring under 600000 the rate is 01 of the value or 015 for non-residents. 7 rows Hawaii. The bill has a defective effective date of July 1 2050.

CO 19-18 Bill 89 Honolulu New Short-Term Rental Rules. Applies for tax years beginning after. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above.

IWKLVLVWKHQDOUHWXUQRIWKHWUXVWRUGHFHGHQWVHVWDWH DOVRHQWHURQOLQH F 6FKHGXOH. Oregon Capital Gains Tax 2020. Increases the capital gains tax threshold from 725 to 9.

Short-term gains are taxed as ordinary income. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. Under current law a 44 tax.

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital.

California Retirement Tax Friendliness Smartasset

Real Estate Or Stocks Which Is A Better Investment

Real Estate Or Stocks Which Is A Better Investment

Akina Yamachika Ponder Legislative Push For Tax Hikes Grassroot Institute Of Hawaii

Is Moving To Hawaii Worth It Forbes Advisor

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Do You Pay Sales Tax On A Used Car In Hawaii 2022

Crypto Taxes How To Calculate What You Owe To The Irs Money

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

1099 Vs W2 Difference Between Independent Contractors Employees

Some Fear Tax Increase Could Dissuade Physicians From Moving To State West Hawaii Today

How To Calculate Capital Gains Tax H R Block

Real Estate Or Stocks Which Is A Better Investment

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

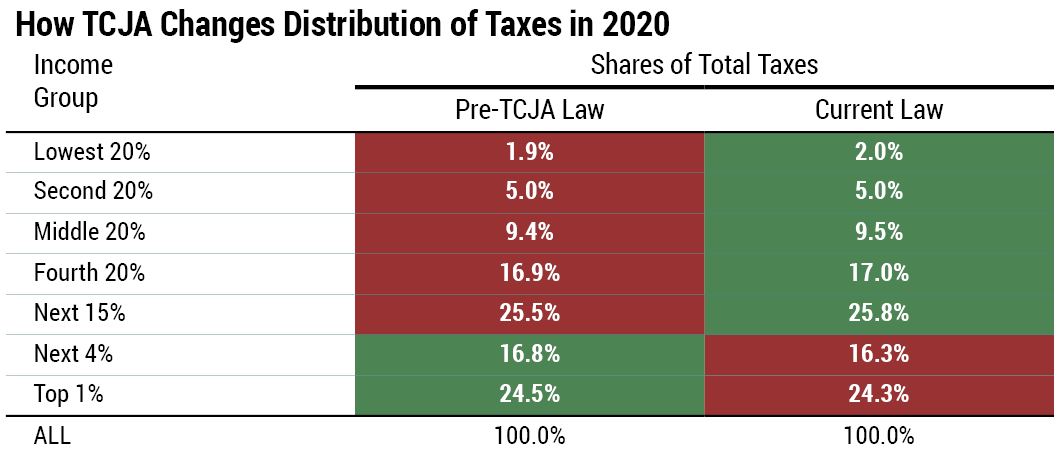

Who Pays Taxes In America In 2020 Itep

Going Green Incentives Sunspear Energy Oahu Solar Company

Why Raising Taxes On The Wealthy Hurts Everyone In Hawaii Grassroot Institute Of Hawaii